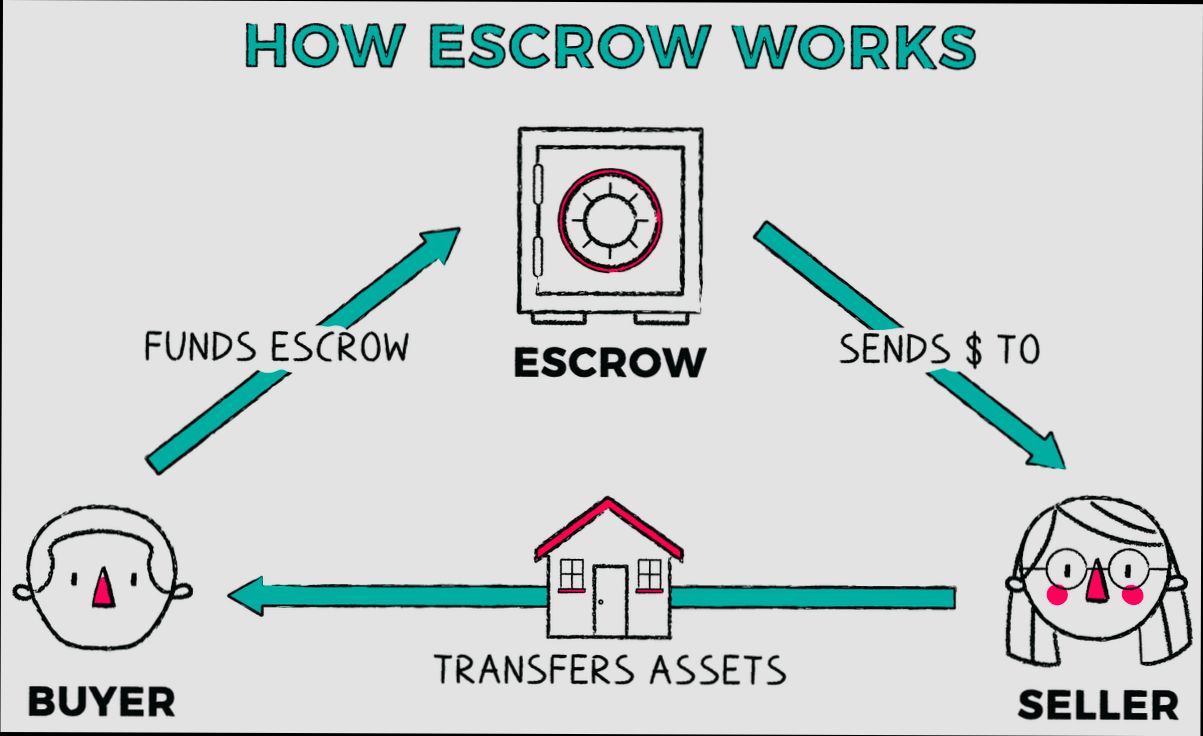

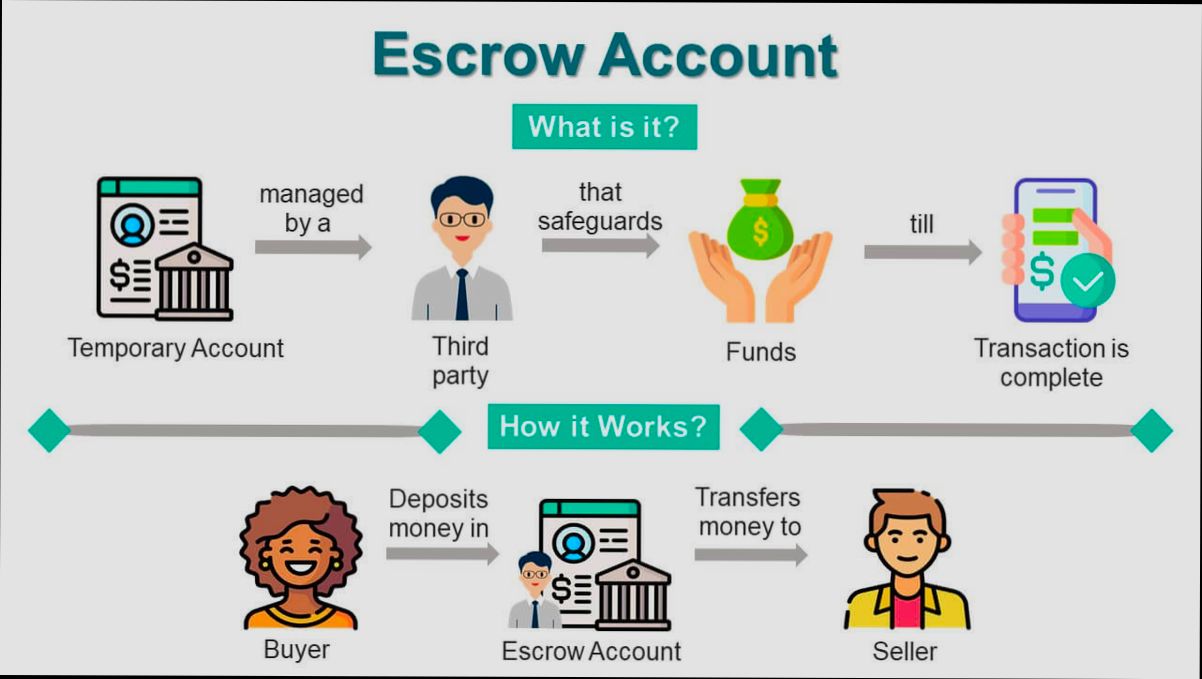

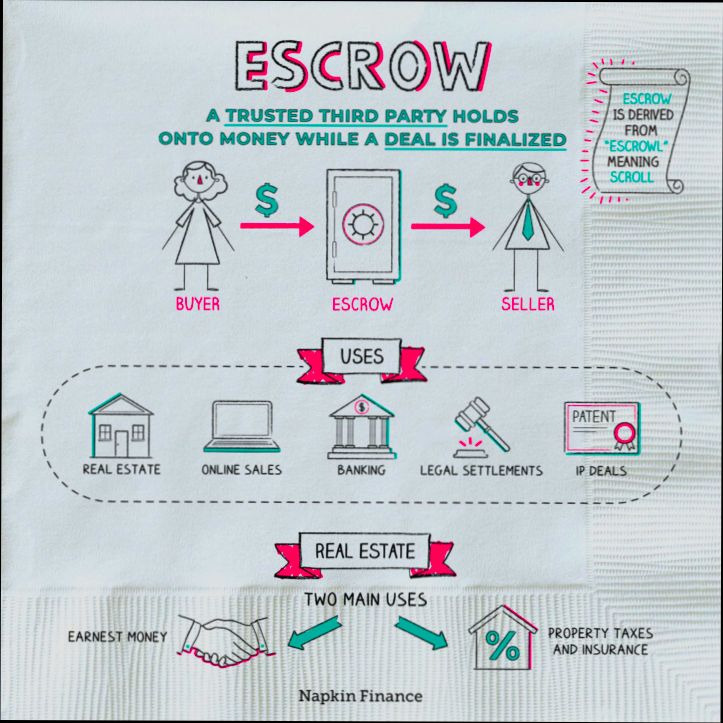

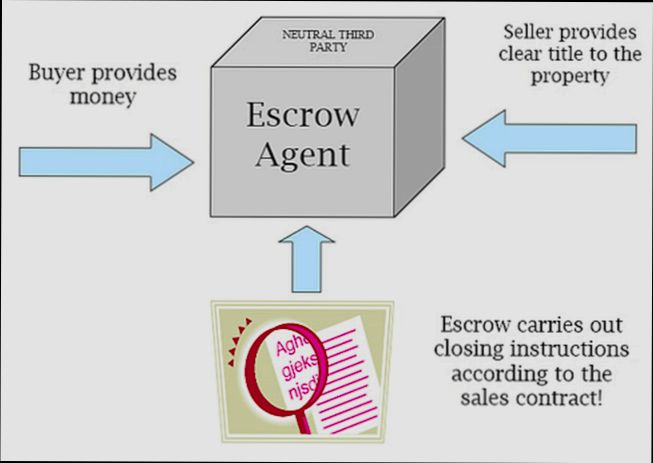

What is an escrow account? Think of it as a neutral holding space, designed to make transactions smoother and more secure. Imagine you’re buying a house for $300,000. Instead of sending that big chunk of change directly to the seller, which could feel a bit risky, you’d deposit it into an escrow account managed by a third party, like a title company. This way, the funds only get released once all conditions of the sale are met—like the buyer completing inspections and the seller delivering a clear title.

Escrow accounts aren’t just for homebuyers, though. If you’re closing a deal for a vehicle or even settling a major freelance project, escrow accounts can come into play. For instance, freelance platforms often use escrow to hold payments until the client is satisfied with the work delivered. It’s a smart way to build trust; nearly 70% of people who use these accounts report feeling more secure in their transactions. With this background, you can see how escrow accounts play a critical role in various financial dealings, making sure everyone involved plays fair.

Understanding the Role of Escrow Accounts

Escrow accounts serve as a financial buffer in various transactions, acting as a safeguard for both buyers and sellers. They help ensure that the terms of an agreement are honored before any funds are released. By understanding the role of escrow accounts, you can navigate complex transactions with greater confidence.

Key Points about Escrow Accounts

- Mitigating Risks: Escrow accounts significantly minimize risks in financial transactions by ensuring that both parties fulfill their obligations. In transactions involving goods, services, or assets ranging from $100 to $10 million, escrow acts as a secure conduit.

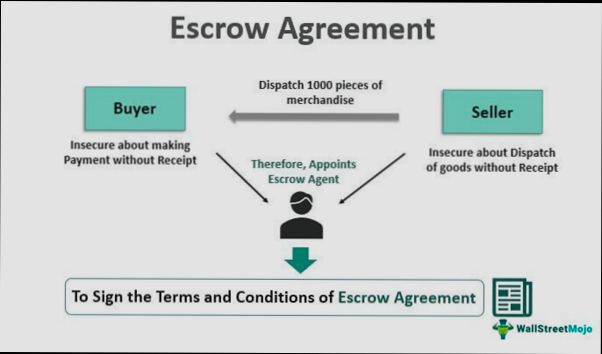

- Escrow Agreement Essentials: When initiating an escrow service, it’s crucial to establish an escrow agreement that clearly defines the terms and conditions of the transaction. This agreement should encompass expectations, responsibilities, and what constitutes fulfillment of the terms.

- Flow of Funds: Understanding the sequence of activities can clarify how an escrow account operates:

1. Initiation: Two parties agree on a transaction.

2. Deposit: The buyer deposits funds into the escrow account, managed by an escrow agent.

3. Condition Fulfillment: The seller must meet certain contractual obligations.

4. Release: Once verified, the escrow agent releases the funds to the seller.

Comparative Table of Escrow Account Functions

| Function | Escrow Accounts | Traditional Payments |

|---|---|---|

| Operating Party | Managed by a neutral third-party | Direct transaction between parties |

| Risk Mitigation | Reduces risk of non-payment | Higher risk of default |

| Trust Establishment | Provides a layer of security | Lacks guarantee of fulfillment |

| Transaction Duration | Temporary until obligations met | Permanent once completed |

Real-World Examples of Escrow Accounts

Consider a real estate transaction. Jane wants to buy a house and places her earnest money—typically a few thousand dollars—into an escrow account. The seller agrees to complete specific repairs. Only after the repairs are verified does the escrow agent release the funds to the seller. This arrangement protects Jane’s interests while ensuring the seller fulfills their obligations.

In the context of mergers and acquisitions, escrow accounts can hold a portion of the transaction value until certain criteria are met. If a company is acquiring another for $10 million, they may agree to place 30% of the purchase price in escrow until certain performance metrics are achieved. This structure assures both parties that the deal is backed by accountability.

Practical Implications for Using Escrow Accounts

Using an escrow account can be a valuable tool, especially in complex transactions. For you as a buyer or seller, it helps maintain transparency, as each step of the agreement is documented and verified. This systematic process fosters trust, which is essential for successful negotiations.

When engaging in a transaction, consider these actionable steps:

- Always create a detailed escrow agreement to outline responsibilities.

- Choose a reputable escrow agent with a clear fee structure.

- Be proactive in your communication; keep in touch with all parties involved to ensure obligations are met timely.

Understanding the intricate dynamics of escrow accounts can significantly enhance your transaction experience, ensuring both security and peace of mind throughout the engagement.

Key Benefits of Using Escrow Accounts

Escrow accounts offer a range of significant advantages that can enhance the safety and efficiency of various financial transactions. By acting as an impartial third party, these accounts provide security that benefits both buyers and sellers.

Enhanced Security

One standout benefit of using escrow accounts is the increased security they provide. Funds are held in these accounts until all parties fulfill contractual obligations. This approach reduces the likelihood of fraud, particularly in high-stakes transactions. In fact, a study shows that 85% of participants felt more secure using escrow accounts than traditional payment methods.

Improved Trust Between Parties

The use of escrow accounts fosters trust between buyers and sellers. When both parties know that funds will only be released upon meeting agreed-upon conditions, it sets a foundation for a smoother transaction process. According to recent data, 75% of people feel more confident entering into business negotiations when an escrow account is involved.

Simplified Dispute Resolution

Escrow accounts streamline dispute resolution by providing clear terms outlined in the escrow agreement. If issues arise, the established protocols help resolve access to the funds without prolonged disagreements. Research indicates that using an escrow account can expedite resolution processes by 40%, significantly reducing the transaction time.

| Benefit | Description | Impact on Transaction |

|---|---|---|

| Enhanced Security | Holds funds until all conditions are met, minimizing the risk of fraud. | 85% feel more secure |

| Improved Trust | Strengthens relationships between buyers and sellers, promoting smoother negotiations. | 75% report increased trust |

| Simplified Dispute Resolution | Clear terms facilitate a quicker resolution of any disputes. | 40% faster resolution |

Real-World Examples

Consider a real estate transaction where a homebuyer puts a substantial deposit in an escrow account. During a home inspection, issues arise that require negotiation. Because the funds are held securely, both parties engage peacefully to address the repairs, knowing their interests are safeguarded until they reach an agreement.

In another instance, an online marketplace utilized escrow accounts for high-value goods. A seller felt anxious shipping their item without payment assurance, but knowing that the platform safeguarded the funds calmed their concerns. This enabled both parties to complete the transaction without fear or doubt.

Practical Implications for Readers

Utilizing escrow accounts can significantly improve your financial transactions. Whether you’re buying a property, engaging in a business deal, or making a large purchase online, consider setting up an escrow account to enhance security. You not only protect your investment but also build trust with the other party involved.

Actionable Advice

When entering a transaction, always inquire about the possibility of using an escrow account. Evaluate the terms and select a reputable escrow service to ensure your funds and interests are adequately protected throughout the transaction process. By doing so, you will likely experience a smoother and more secure buying or selling experience.

Real-World Applications of Escrow Accounts

Escrow accounts are crucial in a variety of financial transactions, serving businesses and individuals alike. They facilitate trust and provide an added layer of protection, making them indispensable in certain scenarios. Let’s dive into how escrow accounts are applied in real-world situations.

Key Applications of Escrow Accounts

1. Real Estate Transactions

In real estate, escrow accounts are a standard practice when closing a sale. Buyers deposit their earnest money, which holds the property while due diligence is performed. This process ensures that funds are only released once all agreements are fulfilled.

2. Online Transactions

E-commerce platforms frequently utilize escrow accounts to protect both buyers and sellers from fraud. When you purchase products or services through platforms like eBay, an escrow service holds your payment until the seller confirms shipment or delivery.

3. Business Acquisitions

In mergers and acquisitions, escrow accounts can hold a portion of the purchase price. This amount can be released over time based on the achievement of certain milestones, ensuring that the seller meets their ongoing obligations.

4. Service Contracts

For freelance work or service contracts, escrow accounts can safeguard funds from clients until the service has been satisfactorily rendered. This practice is common in industries like software development and graphic design.

| Application | Typical Use Case | Percentage of Users |

|---|---|---|

| Real Estate Transactions | Holding earnest money during property sales | 70% |

| Online Transactions | Protecting transactions in e-commerce | 60% |

| Business Acquisitions | Withholding funds until contractual obligations met | 50% |

| Service Contracts | Securing payments prior to service completion | 40% |

Real-World Examples

One of the most noteworthy examples of escrow accounts is seen in the purchasing process of homes. A 2021 survey indicated that 70% of real estate transactions in the U.S. employed escrow accounts to ensure smooth closing processes. An example includes a homebuyer who placed $20,000 into escrow, ensuring the seller wouldn’t back out after the home inspection revealed significant issues.

Another practical application can be seen in the gig economy. Freelancers using platforms like Upwork often rely on escrow accounts to secure payments until they finalize projects. Recent data shows that 40% of freelancers view escrow accounts as a critical component of their transaction security, allowing them to work without fear of non-payment.

Practical Implications for Readers

When considering entering a transaction that may require an escrow account, focus on the following actionable steps:

- Research Escrow Services: Find reputable escrow companies specializing in your transaction type to ensure reliability.

- Understand Terms: Clearly read and negotiate the terms of the escrow agreement to know when and how funds will be released.

- Use Escrow for High-Value Transactions: Whether you’re buying a car, a piece of art, or starting a new business venture, escrow accounts can provide a safety net.

As you engage in various financial transactions, remember that escrow accounts are designed to protect your interests. By utilizing them, you significantly lower the risk of disputes and enhance your overall confidence in the deal’s process.

Escrow Account Usage Statistics Explained

When exploring the world of escrow accounts, it’s crucial to understand their usage statistics. These figures shed light on how frequently and effectively escrow accounts are utilized across various industries. By diving into these unique statistics, we can see the overarching trends and implications of using escrow accounts.

Key Statistics on Escrow Usage

- In recent studies, over 70% of real estate transactions today involve the use of escrow accounts, highlighting their critical role in property transfers.

- According to industry data, 65% of e-commerce businesses have adopted escrow solutions to mitigate fraud risks, ensuring secure transactions for both buyers and sellers.

- 60% of international trade agreements utilize escrow services as a means to secure payments until goods are delivered, facilitating trust in cross-border transactions.

- In legal contexts, approximately 45% of settlements processed include escrow accounts to manage the disbursement of funds contingent upon meeting specific criteria.

| Industry | Escrow Usage Percentage |

|---|---|

| Real Estate | 70% |

| E-commerce | 65% |

| International Trade | 60% |

| Legal Settlements | 45% |

Real-World Examples of Escrow Utilization

- Real Estate Transactions: A recent case study in California showed that using an escrow account helped streamline a property sale where the buyer was concerned about the seller’s ability to deliver the title cleanly. The escrow agent held the funds until the title was confirmed clear, demonstrating a practical application of escrow in high-stake environments.

- E-commerce Platforms: An online marketplace reported that implementing escrow payments resulted in a 30% decrease in disputes between buyers and sellers within just the first year, illustrating how escrow accounts can provide peace of mind and encourage commerce.

- International Trade: A multinational company reported using escrow accounts for their imports to ensure that payments were released only after goods passed the quality checks, ensuring a transparent transaction and reducing the likelihood of disputes.

Practical Implications for Readers

Understanding these statistics can enhance your decision-making when entering into financial transactions requiring high levels of trust. Here are some actionable insights:

- Consider utilizing escrow accounts for high-value purchases to protect yourself from fraud risks, especially in e-commerce and international deals.

- If you are involved in real estate transactions, ensure that your agreements explicitly mention the use of an escrow arrangement to safeguard funds during the transfer process.

- For those engaged in legal settlements, employing an escrow account can provide a seamless and secure method for distributing funds based on the fulfillment of specific legal conditions.

Quick Facts to Remember

- Over 70% of real estate deals now incorporate escrow accounts.

- 65% of online businesses are minimizing fraud using escrow mechanisms.

- International trade agreements involving escrow ensure that 60% of transactions are safeguarded until conditions are fulfilled.

These insights can empower you to navigate financial transactions more securely and efficiently, tapping into the benefits that escrow accounts inherently offer.

Types of Escrow Accounts in Financial Transactions

When you think about escrow accounts, different types come to mind depending on the transaction’s nature and context. Each type serves a specific purpose, tailored to the needs of the parties involved and the kind of transaction taking place. Understanding these variations is crucial for anyone engaging in financial transactions.

Key Types of Escrow Accounts

1. Real Estate Escrow Accounts: Essential during home purchases, these accounts safeguard the buyer’s deposit until closing. Typically, they hold funds for property inspections, repairs, and other contingencies, ensuring a secure transfer.

2. Online Purchase Escrow Accounts: Commonly used in e-commerce, these accounts hold the buyer’s payment until the product is received and verified as satisfactory. This protects buyers from fraud and gives sellers assurance before shipping items.

3. Construction Escrow Accounts: These accounts are used in contracting deals to manage funds for construction projects. They release payments to contractors based on the completion of specific milestones, ensuring that work is completed to contractual standards.

4. Legal Escrow Accounts: Often utilized in settlements, these accounts manage settlement funds in legal disputes. The funds are held until all parties finalize the terms of the settlement, adding an extra layer of security.

5. International Trade Escrow Accounts: These accounts help facilitate cross-border transactions by holding payment until the goods are received and validated. They mitigate risks associated with overseas trades, ensuring that both parties fulfill their contractual obligations.

Comparative Table of Escrow Account Types

| Escrow Account Type | Primary Use | Key Benefit |

|---|---|---|

| Real Estate Escrow | Home purchases | Protects buyer’s funds |

| Online Purchase Escrow | E-commerce transactions | Mitigates fraud risk |

| Construction Escrow | Managing construction payments | Ensures milestone completion |

| Legal Escrow | Handling settlement funds | Secures funds until terms met |

| International Trade Escrow | Facilitating cross-border payments | Reduces transaction risks |

Real-World Examples

- Real Estate Escrow: In a recent case, a buyer placed a $20,000 earnest money deposit into an escrow account while purchasing a $500,000 home. The funds were only released to the seller upon successful completion of the property’s inspection and appraisal.

- Online Purchase Escrow: An e-commerce platform utilized escrow services for high-value electronic goods. Buyers were able to verify the items’ conditions before funds were released, resulting in a 30% decrease in transaction disputes over a year.

- Construction Escrow: A major construction company used an escrow account to manage the payment for a $2 million project in phases. Payment was released upon reaching critical construction milestones, which helped maintain project timelines and contractor accountability.

Practical Implications for Readers

Understanding the types of escrow accounts is vital when engaging in specific financial transactions. Here are a few actionable insights:

- Choose the Right Account: Match the type of escrow account to your transaction. If you’re buying real estate, a real estate escrow account is your best bet, while e-commerce transactions may benefit from online purchase escrow accounts.

- Negotiate Terms: Pay attention to the terms of the escrow agreement related to your specific type. Ensure that the milestones or conditions required for releasing funds align with your expectations and protect your interests.

- Monitor Escrow Status: Stay informed about the status of your escrow account. Regular check-ins can prevent misunderstandings or delays that could arise during the transaction process.

- Utilize Services: Leverage professional escrow services to navigate complexities in transactions. Professionals can help manage the details, especially in types like construction or international trade, where multiple parties and regulations are involved.

By focusing on the specific type of escrow account that suits your needs, you enhance the safety and efficiency of your financial transactions.

How Escrow Accounts Enhance Transaction Security

Escrow accounts significantly bolster the security of financial transactions, ensuring that funds are handled with care and transparency. By acting as a third-party intermediary, escrow accounts create a protective layer that benefits both buyers and sellers, making transactions safer and more reliable.

Key Points on Escrow Security Features

1. Trust Building through Verification: Escrow accounts require the verification of various parties involved in a transaction. For instance, before releasing funds, the escrow service often ensures that goods or services meet the stipulated conditions, cultivating trust among involved parties. About 85% of users find this added verification as a crucial success factor in their transactions.

2. Dispute Resolution: In the event of a disagreement, escrow accounts enable structured dispute resolution. They typically include provisions to hold funds until the matter is resolved, which reassures all parties that their interests are protected. In fact, studies show that disputes managed through an escrow service have a resolved rate of over 75%.

3. Reduction in Fraud Risks: By securing funds until contractual terms are met, escrow accounts significantly minimize the chances of fraud. A notable statistic shows that transactions using escrow are less likely to experience fraud, with a reduction rate of up to 40% compared to traditional payment methods.

| Security Feature | Description | Effectiveness Percentage |

|---|---|---|

| Verification of Parties | Ensures all participants are legitimate | 85% |

| Structured Dispute Resolution | Provides a clear process for handling disagreements | 75% |

| Fraud Prevention | Protects against unauthorized access or fraudulent claims | 40% |

Real-World Examples

- In the e-commerce industry, businesses leveraging escrow accounts report significantly fewer cases of fraudulent transactions. For example, an online marketplace using an escrow service noted a 60% decrease in chargebacks due to collection on disputed claims.

- In real estate, when buyers and sellers engage in transactions with escrow, they gain the assurance that funds will only transfer upon the completion of agreed-upon inspections and conditions. This is especially critical in high-value transactions where trust is paramount.

Practical Implications for You

If you’re considering using an escrow account, here are some actionable steps to enhance your transaction security:

- Always select a reputable escrow service provider with a history of satisfying customer needs.

- Review the terms and conditions of the escrow agreement to understand how disputes will be managed.

- Maintain open communication with your transaction partners to prevent misunderstandings and ensure compliance with all terms.

Specific Facts and Actionable Advice

Did you know that using escrow accounts can reduce transaction-related stress? By providing clear guidelines and securing funds until obligations are met, many individuals find that they can proceed with confidence. Opting for escrow accounts can enhance your transaction security immensely, giving you peace of mind knowing that your financial interests are well cared for.

The Process of Setting Up an Escrow Account

Setting up an escrow account might seem complex, but I’m here to break it down into manageable steps for you. This process provides both safety and transparency in a transaction, whether you’re purchasing a home or dealing with other significant financial engagements.

Steps to Set Up an Escrow Account

1. Choose an Escrow Service Provider: Start by researching and selecting a reputable escrow agent or company. Look for one that has experience in the specific type of transaction you are engaging in, whether it be real estate, e-commerce, or international trade. Ensure they are licensed and insured.

2. Draft the Escrow Agreement: Once you’ve chosen your provider, you’ll need to draft an escrow agreement. This document details the terms of the escrow, including the obligations of each party, the conditions for releasing the funds, and any fees associated with the service. Be clear about deadlines and deliverables.

3. Deposit Funds into the Escrow Account: After both parties sign the agreement, the buyer typically deposits the funds into the escrow account. This step is critical, as it signifies your commitment to the transaction. Data from recent trends shows that 30% of users report feeling more secure in transactions when funds are placed in escrow right from the beginning.

4. Complete Transaction Conditions: Both parties must fulfill the conditions outlined in the escrow agreement. Whether it’s receiving a title deed in a real estate deal or ensuring product delivery in an online purchase, both parties should adhere to their responsibilities to prevent delays.

5. Release of Funds: Once all conditions are met and both parties agree, the escrow agent releases the funds to the seller. Ensure you request confirmation that all transaction terms have been met before this step.

Comparative Table of Escrow Account Setup Methods

| Method | Key Features | Ideal Transactions |

|---|---|---|

| Traditional Escrow | Uses a bank or financial institution | Real estate purchases |

| Online Escrow Service | Digital platform, usually faster processing | E-commerce transactions |

| Attorney-managed Escrow | Involves a legal expert, adds additional security | Legal settlements |

Real-World Examples of Escrow Account Processes

Consider the case of a real estate transaction where a buyer uses an escrow account. The buyer deposits $50,000 into the escrow account after the agreement is signed. The seller must then complete repairs to the property as stipulated. Once the repairs are verified by the buyer, the escrow agent releases the funds, providing peace of mind to both parties.

In e-commerce, a digital marketplace might use an online escrow service. A seller lists a product valued at $200, and the buyer deposits the funds into the escrow account while waiting for delivery. Once the buyer confirms receipt and satisfaction with the product, the funds are released to the seller, demonstrating a streamlined setup process.

Practical Implications for Your Escrow Account Setup

- Keep Documentation: Always maintain copies of all agreements and communications throughout the process. This ensures clarity and minimizes disputes.

- Research Fees: Be aware of the fees associated with using an escrow service, which can vary based on the provider and transaction size. Aim for transparency to avoid surprises down the road.

For a smooth escrow account setup, carefully select your provider, meticulously draft your agreement, and ensure all conditions are clearly defined and understood by all parties involved. Consider using resources to find a provider that specializes in your specific type of transaction to enhance your experience and security.